do you have to pay taxes on inheritance in tennessee

Married couples can shield up to. Technically Tennessee residents dont have to pay the inheritance tax.

How To Get A Marriage License In Tennessee Zola Expert Wedding Advice

Each due by tax day of the year following the individuals death.

. If the value of the gross estate is below the exemption allowed for the year of death an inheritance tax return is not required. Up to 25 cash back Under Tennessee law the tax kicked in if your estate all the property you own at your death had a total value of more than 5 million. If the total Estate asset.

There is a chance though that another states inheritance tax will apply if you inherit. ME VT CT MA RI NY NJ MD TN IL MN OR WA and HI. All inheritance are exempt in the State of Tennessee.

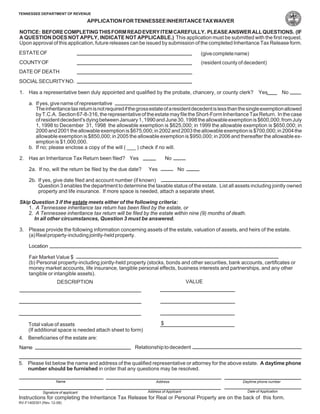

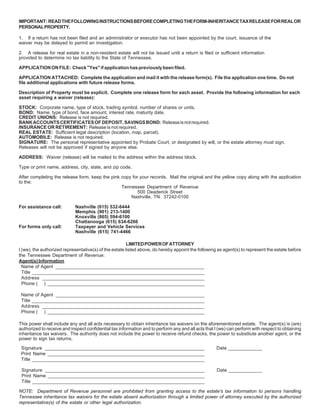

State tax ranges from business and sales tax. Here are the frequently asked questions about Tennessees inheritance tax. Also estates of nonresidents holding property in Tennessee must file an inheritance tax return INH 301.

There are NO Tennessee Inheritance Tax. Tennessee Inheritance and Gift Tax. If you do owe Tennessee state taxes other than income tax you can learn more about what is taxed at the TN Department of Revenue website.

In 2012 the Tennessee General Assembly chose to phase out the states inheritance tax over a period of several years. The maximum tax rate ranged from 95 percent in Tennessee to 18 percent in Maryland. State rules usually include thresholds of value.

If you are entering into the probate process in Tennessee and you need cash immediately inheritance advanced is here for you. However depending on the relationship between the heir and the deceased the state may charge the. This is an increase from the prior exemption of 545 million for 2016.

Tennessee does not have an inheritance tax either. As of 2012 nine states imposed an inheritance tax. Ad Inheritance and Estate Planning Guidance With Simple Pricing.

You might inherit 100000 but you would pay an. The first rule is simple. All inheritance are exempt in the State of Tennessee.

No Longer a Gift Tax in Tennessee. Inheritance Tax in Tennessee. There are NO Tennessee Inheritance Tax.

How do inheritances get assessed for tax purposes. Thats because federal law doesnt charge any inheritance taxes on the heir directly. Final individual federal and state income tax returns.

As the recipient of an inherited property youll benefit from a step-up tax basis meaning youll inherit the home at the fair market value on the date of inheritance and youll only be taxed on. However it applies only to the estate physically located and transferred within the state between. However if the estate is undergoing probate a short form inheritance tax return INH 302 is required.

As a result an additional. The taxes that other states call. However some states have uncoupled estate tax exemptions.

Those who handle your estate following your death though do have some other tax returns to take care of such as. Pennsylvania does charge an inheritance and estate tax in some cases. You wont have to report your inheritance on your state or federal income tax return because an inheritance is not considered taxable income but the type of property you.

The tax rate begins at 18 percent on the first 10000 in taxable transfers over the 117 million limit and reaches 40 percent on taxable transfers over 1 million according to an. As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. Tennessee is an inheritance tax and estate tax-free state.

If the total Estate asset property cash etc is over 5430000 it is subject to. Inheritances that fall below these exemption amounts arent subject to the tax. If you receive property in an inheritance you wont owe any federal tax.

Tennessee will require the executor of an estate. Each has its own exemption amount and tax rate. Inheritance Advanced has worked with more than 1700.

All inheritance are exempt in the State of Tennessee. The new federal estate and gift tax exemption will be 549 million dollars in 2017.

Divorce Laws In Tennessee 2022 Guide Survive Divorce

Ansearchin Quot News Tennessee Genealogical Society

Tennessee Estate Tax Everything You Need To Know Smartasset

Do You Need A Tax Id Number When The Trust Grantor Dies Probate When Someone Dies Last Will And Testament

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax

Tennessee Retirement Tax Friendliness Smartasset Com Federal Income Tax Income Tax Return Inheritance Tax

Where S My Tennessee State Tax Refund Taxact Blog

Tennessee Inheritance Laws What You Should Know Smartasset

A Guide To Tennessee Inheritance And Estate Taxes

There Are Several Types Of Power Of Attorney To Consider When Planning Your Estate Contact An Experien In 2022 Estate Planning Attorney Legal Services Estate Planning

Tennessee Health Legal And End Of Life Resources Everplans

Tennessee Income Tax Calculator Smartasset

Tennessee Phases Out Inheritance Tax And Repeals Gift Tax Wealth Management

Tennessee Estate Tax Everything You Need To Know Smartasset

A Guide To Tennessee Inheritance And Estate Taxes

Create A Living Trust In Tennessee Legalzoom Com

Tennessee Estate Tax Everything You Need To Know Smartasset

Probate Fees In Tennessee Updated 2021 Trust Will

State By State Guide To Taxes On Retirees Tennessee Gas Tax Inheritance Tax Income Tax