does indiana have a inheritance tax

En español Most people dont have to worry about the federal estate tax which excludes up to 1206 million for individuals and 2412 million for married couples in 2022 up from 1170 million and 2340 million respectively for the 2021 tax year. Unlike estate taxes which are paid by the estate of the deceased inheritance taxes are paid by the beneficiaries of the deceased.

Indiana Inheritance Tax Is Your Inheritance At Risk Indianapolis Estate Planning Attorneys

New Jersey Nebraska Iowa Kentucky and Pennsylvania.

. It doesnt matter how large the entire estate is. Below we detail how the estate of Indiana will handle your estate if theres a valid will as well as who is entitled to your property if you have an invalid will or none at all. Twelve states and Washington DC.

It operates almost like an inheritance tax on the heirs but it is much more severe and it is levied through the INCOME TAX SYSTEM. Below are the ranges of inheritance tax rates for each state in 2021 and 2022. Does Indiana have inheritance or estate taxes.

Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as. You should certainly have a comprehensive understanding. However other states inheritance laws may apply to you if.

Impose estate taxes and six impose inheritance taxes. Although some Indiana residents will have to pay federal estate taxes Indiana does not have its own inheritance or estate taxes. 31 2012 no inheritance tax has to be paid.

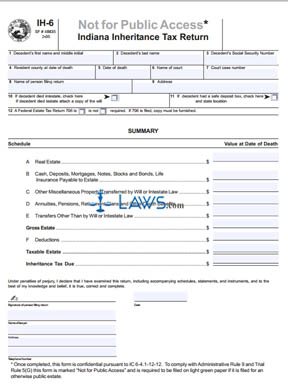

Are required to file an inheritance tax return Form IH-6 with the appropriate probate court if the value of transfers to any beneficiary is greater than the exemption allowed for that beneficiary. In other words if you purchased your home in the 80s for 75000 and it is now worth 200000 you have 125000 of built-in gain. At this point there are only six states that impose state-level inheritance taxes.

Indiana Inheritance and Gift Tax. No tax has to be paid. For individuals dying before January 1 2013.

Maryland is the only state to impose both. If you inherited an immovable property youll also need to pay property taxes. Inheritance tax applies to assets after they are passed on to a persons heirs.

Just five states apply an inheritance tax. For individuals dying after Dec. If inheritance tax is paid within three months of the decedents death a 5 percent discount is allowed.

Heres a quick summary of the new gift estate and inheritance changes that came along in 2022. Whereas the estate of the deceased is liable for the estate tax beneficiaries pay the inheritance tax. We had an inheritance tax in Indiana but it was repealed.

There is also an unlimited charitable deduction for inheritance tax purposes. Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania. Indiana does not have an inheritance tax nor does it have a gift tax.

The tax is not applicable if the decedent passed away after December 31st of 2012. In fact the Indiana inheritance tax was retroactively repealed as of January 1st of 2013. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

Here in Indiana we did have an inheritance tax and this is why some people assume that we are one of these states. Code 6-41-3 et seq. Indiana has a three class inheritance tax system and the exemptions and tax rates vary between classes based on the relationship of the recipient to the decedent.

The tax rate is based on the relationship of the inheritor to the deceased person. Inheritance tax is levied on assets after they have been transferred to a persons heirs or beneficiaries. In addition Indiana does not have an inheritance tax.

But 17 states and the District of Columbia may tax your estate an inheritance or both according to the Tax Foundation. However you may need to pay income tax capital gains tax and wealth tax on your inheritance. On the federal level there is no inheritance tax.

So the net effect was that high income and high asset people were moving to other states does lowering overall taxes. There is no federal inheritance tax and only six states have a state-level tax. Indianas inheritance tax still applies.

The federal estate and gift tax exemption has been increased from 5000000 in 2017 to 10000000 in. Indianas inheritance tax is imposed on certain people who inherit money from someone who was an Indiana resident or owned property real estate or other tangible property in the state. In general estates or beneficiaries of.

Inheritance tax payments are due upon the death of the decedent and become delinquent nine months after the individuals death. There is also a tax called the inheritance tax. And both federal and state governments can apply estate taxes which are levied against the assets that are bequeathed.

There are 12 states that have an estate tax. There is no inheritance tax in Indiana either. The Inheritance tax was repealed.

They are New Jersey Maryland Pennsylvania Nebraska Iowa and Kentucky. Very few people now have to pay these taxes. Washington Oregon Minnesota Illinois New York Maine Vermont Rhode Island.

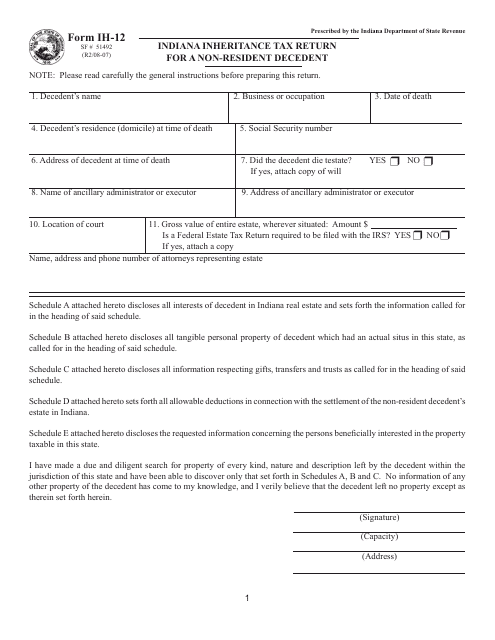

At the present time there are only six states that still have inheritance taxes. No inheritance tax returns Form IH-6 for Indiana residents and Form IH-12 for nonresidents have to be prepared or filed. However many states realize that citizens can avoid these taxes by simply moving to another state.

The decedents surviving spouse pays no inheritance tax due to an unlimited marital deduction. States have typically thought of these taxes as a way to increase their revenues. It may be used to state that no inheritance tax is due as a result of Decedents death after application of the exemptions provided by Ind.

India doesnt have inheritance tax.

Indiana Inheritance Laws What You Should Know Smartasset

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys

Indiana Inheritance Laws What You Should Know Smartasset

Indiana Inheritance Laws What You Should Know Smartasset

Dor Indiana S Tax Dollars At Work

How Do State Estate And Inheritance Taxes Work Tax Policy Center

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Calculating Inheritance Tax Laws Com

What Should I Do With My Inheritance Inside Indiana Business

State Estate And Inheritance Taxes

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Download Instructions For Form Ih 6 Indiana Inheritance Tax Return Pdf Templateroller

State Form 51492 Ih 12 Download Fillable Pdf Or Fill Online Indiana Inheritance Tax Return For A Non Resident Decedent Indiana Templateroller

Free Form Ih 6 Indiana Inheritance Tax Return Free Legal Forms Laws Com

Top Five Strategies For Avoiding Estate Taxes Infographic Indianapolis Estate Planning Attorneys

Does Indiana Have An Inheritance Tax Indianapolis Estate Planning Attorneys